Property Taxes By State Map

Property taxes are an important tool to help finance state and local governments. Higher sales and property taxes can be tough on your tax bill after you retire regardless of state income tax. Washington has 39 counties with median property taxes ranging from a high of 357200 in King County to a low of 94100 in Ferry CountyFor more details about the property tax rates in any of Washingtons counties choose the county from the interactive map or the list below. In order to rank property taxes by state from highest to lowest researchers compared all 50 states and the District of Columbia.

To What Extent Does Your State Rely On Property Taxes Tax Foundation

To What Extent Does Your State Rely On Property Taxes Tax Foundation

So if youre trying to keep costs at a minimum in your new home its always a good idea to see how much youll be expected to pay in property taxes every year.

Property taxes by state map. Benton County in the northwest part of the state levies an average 06 property tax. Click a county to zoom in and click it again to zoom out. Local taxes can be a burden as well. For a nationwide comparison of each states highest and lowest taxed counties see median property tax by state.

How School Funding S Reliance On Property Taxes Fails Children Npr

How Do State And Local Property Taxes Work Tax Policy Center

How Do State And Local Property Taxes Work Tax Policy Center

Tax Foundation Proposed Tax Rate Increases Undo Impact Of Property Tax Cuts

Tax Foundation Proposed Tax Rate Increases Undo Impact Of Property Tax Cuts

Monday Map State Local Property Tax Collections Per Capita Property Tax Map Teaching Economics

Monday Map State Local Property Tax Collections Per Capita Property Tax Map Teaching Economics

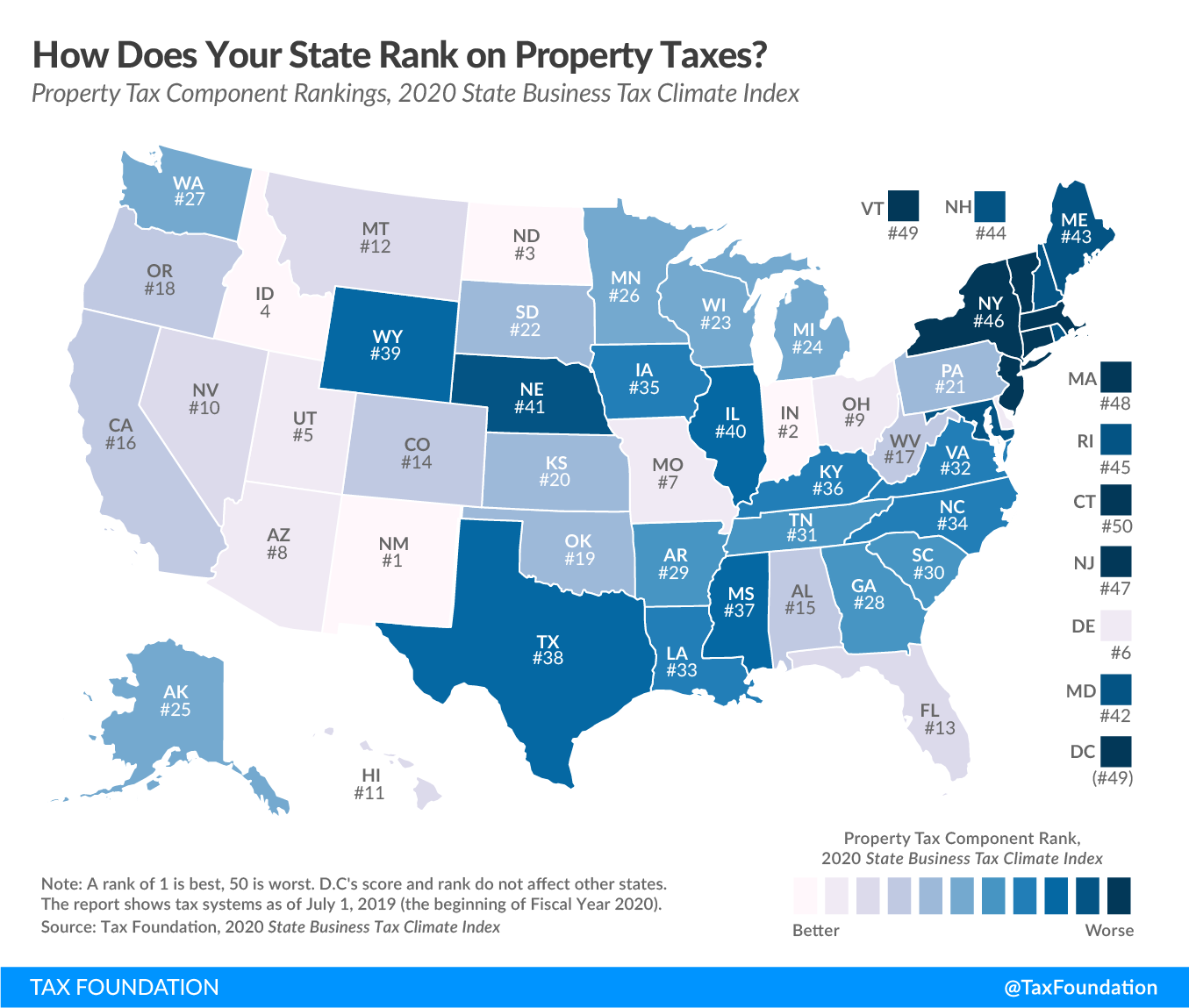

Property Tax Map Tax Foundation

Property Tax Map Tax Foundation

States With The Highest And Lowest Property Taxes Property Tax States State Tax

States With The Highest And Lowest Property Taxes Property Tax States State Tax

Best Worst Property Tax Codes In The U S Tax Foundation

Best Worst Property Tax Codes In The U S Tax Foundation

This App Works Best With Javascript Enabled Billtrack50 Tracking Legislation Trackingregulation Tracking Sharing Widgetsscorecardsstakeholder Pagesmobile Stakeholder Page Pricing About Blog Contact Free Signup Log In Property Taxes In Your

This App Works Best With Javascript Enabled Billtrack50 Tracking Legislation Trackingregulation Tracking Sharing Widgetsscorecardsstakeholder Pagesmobile Stakeholder Page Pricing About Blog Contact Free Signup Log In Property Taxes In Your

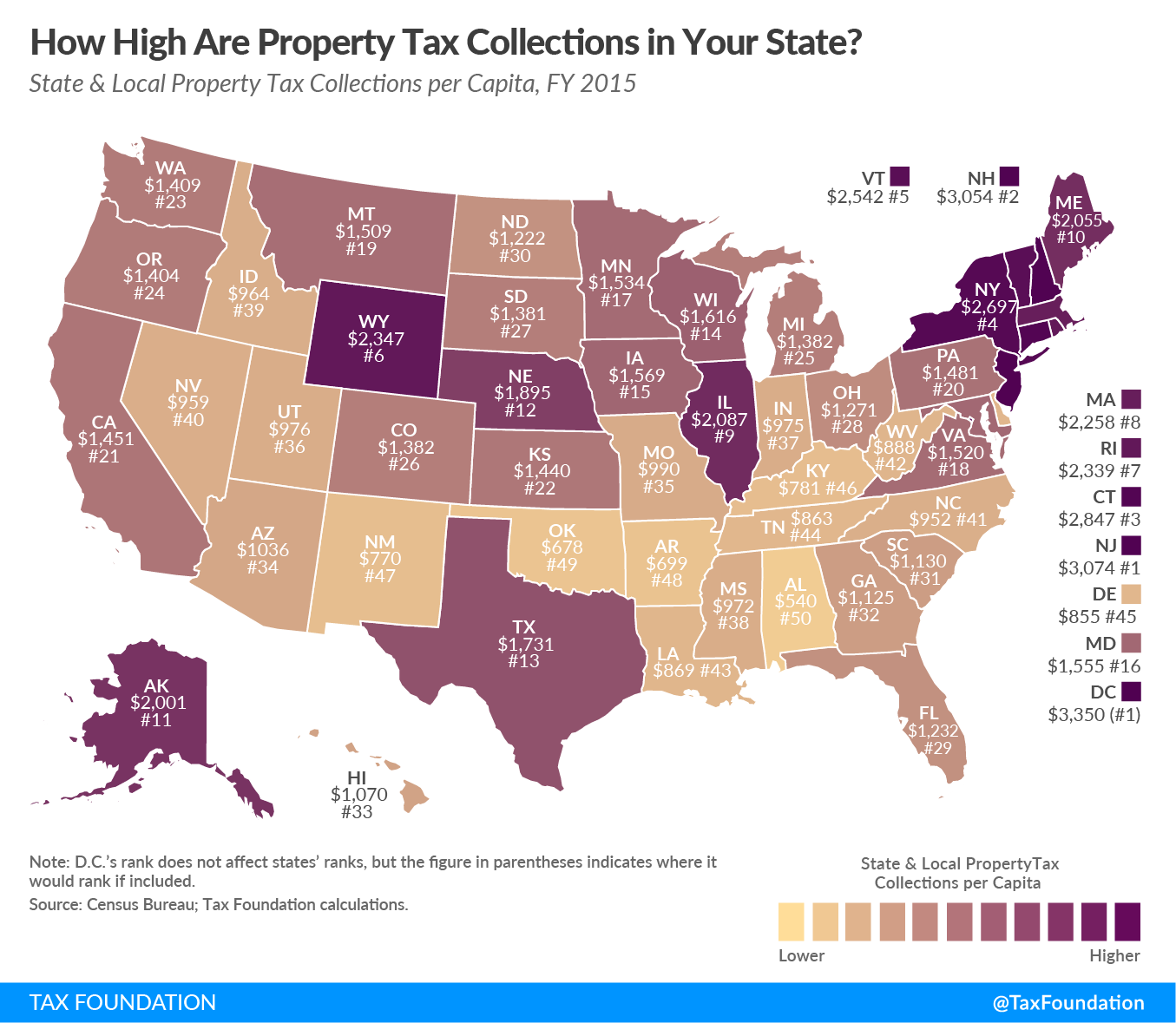

How High Are Property Tax Collections In Your State Tax Foundation

How High Are Property Tax Collections In Your State Tax Foundation

0 Response to "Property Taxes By State Map"

Post a Comment